How did the year end for Simi Valley home sales in 2012? Did the real estate market live up to all hype from the industry and media coverage?

How did the year end for Simi Valley home sales in 2012? Did the real estate market live up to all hype from the industry and media coverage?

Remember that real estate markets are local, even hyper local. What may happen in some price ranges and some other areas may not always occur in our market.

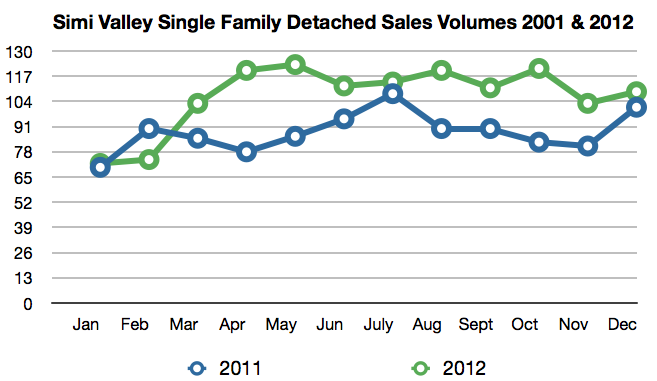

Last year (2012) ended up being a very good year for real estate sales in Simi Valley. In fact, there are many positive results that we have not seen for more than six years. The first and foremost positive news of the year was that even though January and February started off slow, the year ended with an average of 107 single-family detached units selling each month. The Simi Valley real estate market had not seen a monthly number over 100 units since 2006 with the average being approximately 80 houses selling each month from 2007 to 2010 with a slight uptick to 88 in 2011.

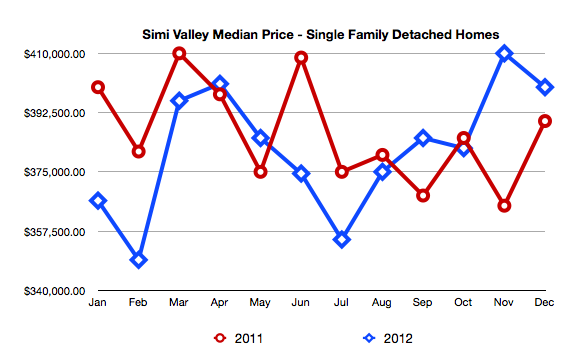

The big story and continuing story is the highly restricted inventory levels. Simi Valley and many parts of Southern California are experiencing less than one month supply of homes for sale on the market. Typically a 3 to 5 month supply is considered normal market conditions. With fewer than 90 active homes for sale on any given day of the week, stiff competition has helped stabilize pricing and push median prices up to the $400,000 mark.

Lending requirements still remain strict and banks have had to aggressively lower interest rates to keep buyers interested in the market. Interest rates of 3 1/2% and lower for 30 year fixed mortgages are not uncommon over the last couple of months.

The total units sold for the year was 1,303 single-family Simi Valley detached homes. This roughly breaks out into a 50-50 split between distressed properties and non-distressed properties. Short sales still lead the distressed property market with 420 units closing last year. Followed with 196 units in the foreclosure market. There were 662 units of non-distressed property sold. Modest improvement in median price and average price in the Simi Valley real estate market is encouraging, however only 26% of the non-distressed sales last year sold for list price or above. While competition for the few homes available for sale help stabilize and move prices upward; price appreciation in the market is still tied to values heavily influenced by appraisals in these transactions.

Not discussed often, home buyers are cognizant of the rental payment paradigm, in that they are concerned their mortgage payment is at par or below current area rental property rates. Continuing low inventory, and low interest rates will help move pricing up, but expect the market to slow if price appreciation or an increase in interest rates push mortgage payments above rental property rates rates.

Another interesting note is, that investors both institutionally and individuals were very active in purchases for both rental property and rehabilitation flips. Investors have been active the last couple years, but the influx of money from large investment groups buying individual rental properties has probably been the most interesting development over the last quarter of 2012.

My thoughts for 2013 are as follows:

- Low interest rates are one of the key driving factors of this market. The negative side effect of interest rates this low is that any upward movement in interest rates will slow price appreciation.

- Low inventory is the other key driving factor of this market. Any influx of inventory back to three or more months supply, will take the competitive environment out of this current market rally.

- Strict lending requirements have all but eliminated the main people who drive markets. Those who can qualify for loans currently are low risk takers and tend not to get overly wound up in competitive market conditions. While the market will continue on the same pace if inventories and interest rates stay the same, home buyers are not just taking anything thrown in front of them at any price.

- Short sales and foreclosures will be with us at these continuing levels for a while. No income – no asset verification loans with 7 to 10 year interest only options were being made all the way into the early fourth quarter of 2007. Those loans start adjusting in 2014 through 2017, not to mention loans made prior to that point that are adjusting now through 2016.

- Rental Rate vs Mortgage payment – This is a delicate balance. I do not expect Home Buyers to drive pricing to a point where the monthly payment for a home is more than what a home can rent for.

_______________________________________________________________________

“Good” is a relative term. As somebody who wants to buy his first home some day, rising prices is “Bad”.

Currently Richie, housing is at all time affordable pricing now, interests rates are the lowest they have ever been. The monthly mortgage payment for a home at today’s median home price is lower that what it was for a home in 1989 at the 1989 median price, why? 10% interest vs 3.5% interest today. Pricing hit it’s low last year and started to stabilize and rebound by the end of the year, but the rise in pricing is still very small and the monthly payment is still below rental rates.