Simi Valley Homes Sales in August 2011 for single family detached units slowed. The pullback is not alarming and was something I anticipated after such a strong showing in July for the following reasons:

Simi Valley Homes Sales in August 2011 for single family detached units slowed. The pullback is not alarming and was something I anticipated after such a strong showing in July for the following reasons:

- People like to move before school starts (contributing to July increased sales).

- Prices have continued to decline making many Simi Valley homes for sale attractive-good-buys.

- Interest Rates continue at historic low rates. (Money is cheap)

- National Economic News in August and big drops in the Stock Market rocked consumer confidence.

- The Political Atmosphere in Washington DC (created by all parties) is killing consumer confidence.

The average sales price showed some rebound, but I want to recap what the average sales price and the median sales price really tells us.

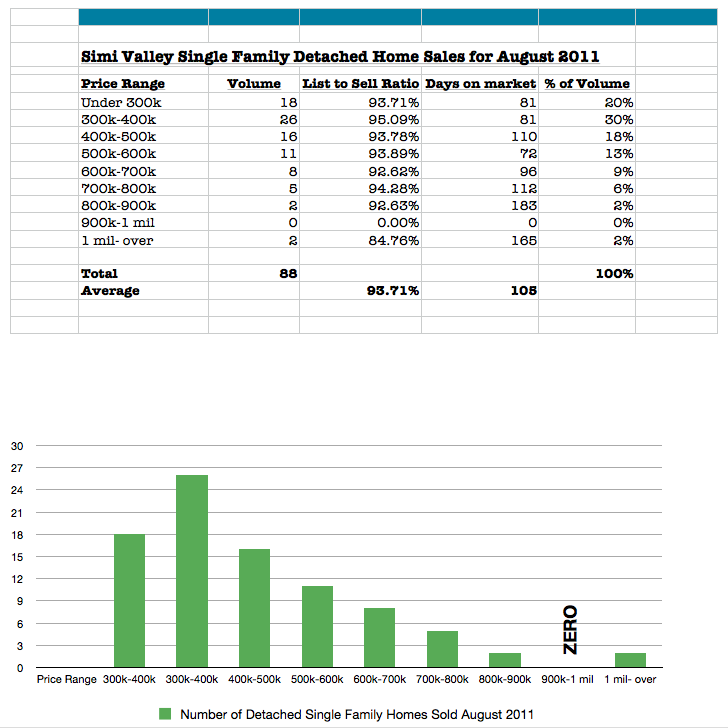

If you look at the charts I post each month, I break down the sales in price brackets by $100,000 ranges. You can see each month that the bulk of all Simi Valley single family detached homes are selling under $500,000. Some months no houses sell in the upper end of the market and when this happens the average sales price can swing pretty dramatically. In the recent months that swing was influenced by a larger number of homes selling under $300,000. This trend started in January 2011 and continued on through August.

The Average Price method of looking at the market can give a good idea of how the upper end of the housing market is moving. dramatic decreases in average sales price indicates the upper end units are not selling. While the the Median price reveals more of how the average all market is reacting in general.

The last three years has revealed that the low end is selling, what is interesting to watch is how the upper end of the Market (above $500,000) is selling. When Prices are aggressive and interest rates are low investors and landlords come in on the lower end properties as we have been seeing this year in Simi Valley. The general public typically lags behind the investor activity. A healthy market in the upper price ranges can indicate better employment opportunities (an improving economy). It can signal that employers may look to Simi Valley as a place to locate and it can bolster the local economy with a higher demographic of shoppers, all of which can influence property prices upward.

The summary is that the upper markets are still struggling, and the over all perception of good buys is fully being realized by investors and those with conventional financing looking to lock in low interest rate for the long haul.

Past Market Reports:

- Simi Valley July 2011 Home Sales Surge on Volume Average Sale Price drops $57k

- Simi Valley June 2011 Real Estate Market Report

- Simi Valley May 2011 Real Estate Market Report

Thanks for reading Simi Valley’s Premiere Real Estate Blog!

Author – Ted Mackel Simi Valley Real Estate Agent – Keller Williams Realty

Ted Mackel is a top producer at Keller Williams Realty Simi Valley,

specializing in Simi Valley Real Estate

(805) 432-7705

Leave a Reply