The Simi Valley Real Estate Market has changed dramatically in 2012, but not in the the ways most would hope for. There are several major factors fueling the market, but like any house of cards, what has happened since March of this year can stop as fast as it has started.

While real estate places in cities like Boston steadily dropping, meaning that you should either sell your Boston home fast or prepare to hold the property for a long time while the market recovers, the following factors are key drivers to the increase in sales volumes for Simi Valley housing:

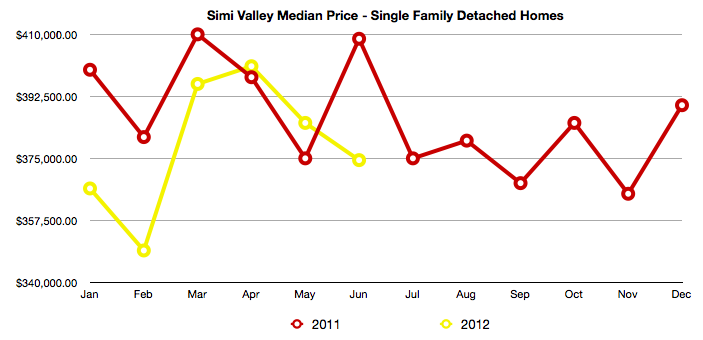

Low inventory – The number of homes Available for sale has been dropping steadily since the 4th quarter of last year. The supply has been under 1.5 months for quite a while. What does 1.5 months supply mean to the market? Four months supply is a normal balanced supply, a tighter supply as we have been seeing is supposed to create competition and drive pricing up, but if we look at the numbers for the year and compare it to 2011, it is crystal clear that tight inventory is having very little influence on home prices.

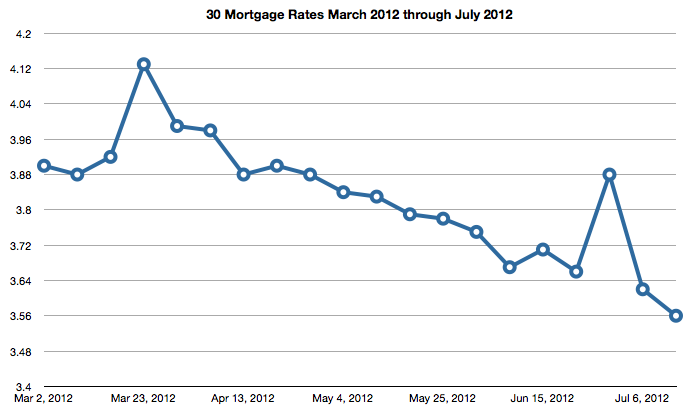

Low interest rates – Rates are at lifetime lows. Money keeps getting cheaper and cheaper and it’s a wonder why so many buyers still think that the market has not hit bottom yet. No one can accurately predict the bottom, but room for significant downward pressure on pricing does not exist when the 30 year mortgage interest rates have moved significantly below 4% .

Low pricing – With a 10%-9% drop in pricing from February 2011 – to February 2012, how much lower can prices go. Simi Valley saw increased sales of single family homes under $300,000 double and triple their normal rate. In June that activity tailed off. Understanding if the market is on the mend could be hard for most looking to buy or sell. Increasing home prices are the lagging factor of a recovering market. Sales volumes are a better bench mark to watch. If more people are will to enter the market and make a purchase over time that will translate into a move up in pricing. Beware however, that move upward will be gradual.

Do you want to know why home prices are not driving upward in Simi Valley? The buyer pool is the main culprit. Lending requirements are so strict that those that do qualify for non FHA financing are very frugal and conservative with their money. These are the people that are very good savers, they don’t over pay, they take little risk. This group will not drive up pricing with low inventory, low interest rates and low pricing.

Until lending requirements loosen up enough to let those more willing to take on risk, the market will continue to react as it has much of the last 12 to 18 months. I am not talking about going back to the problematic lending we had up through 2007, but higher income/asset borrowers need access to stated income loans.

Low inventory can work to the advantage of the Seller but with the financially conservative nature of home buyers and the appraisers unwilling to move up pricing, negotiating will be part of the process in completing the sale. Money is cheap, and cheap money is always smart money. Making a purchase now with cheap money can make loan pay off a realistic goal.

[…] By Ted Mackel, 365 Things to do in Simi Valley, CA & Ventura County – San Fernando Valley Real Estate Guide – July 13, 2012 at 07:32PM […]