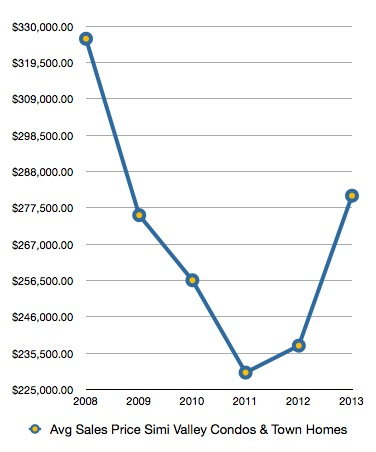

Housing activity in Simi Valley for August 2013 is beginning to show some easing. While the $400,000 a $500,000 price range continues to dominate sales, the list to sell ratio in almost all price categories is starting to back off. This is still a strong seller’s market however homes are selling just under full list price and multiple offers are common. The pressure on the lower priced single-family detached homes has helped the Simi Valley condominium/ townhome market rebound as is these properties have become the affordable replacement for a single-family detached home.

Housing activity in Simi Valley for August 2013 is beginning to show some easing. While the $400,000 a $500,000 price range continues to dominate sales, the list to sell ratio in almost all price categories is starting to back off. This is still a strong seller’s market however homes are selling just under full list price and multiple offers are common. The pressure on the lower priced single-family detached homes has helped the Simi Valley condominium/ townhome market rebound as is these properties have become the affordable replacement for a single-family detached home.

Interest rates for financing purchases peaked at 4.46% for the month which will slow or curtail any type or run away price increases. Inventory is now double what was 18 months ago and distressed properties represent less than 18% of all the properties that sold in August. This is quite a significant shift from last year when distressed properties were still commanding 30%, 40% or even 50% of the sales in any given month. Foreclosures are few and far between and those looking to the foreclosure market for a deal will be battling with many others as Simi Valley only had two foreclosures close escrow in August.

The backlog of escrows that has plagued the market for the last several years has been reduced to a fairly manageable level. Currently there are just over 200 homes under contract, this is approximately 40% more homes that are selling each month. 60 properties currently in escrow of this 200 are currently short sales. Short sale escrow times typically run several months so of these 60 properties only a small percentage will actually close in September.

The California Association of Realtors most recent report shows that statewide trends are not much different than what is happening in Simi Valley. The Simi Valley inventory is under two months supply, but that is up to the first and second quarter when there was less than one month supply. The California Association of Realtors reported the following:

• The available supply of existing, single-family detached homes for sale inched up in August to 3.1 months, up from July’s Unsold Inventory Index of 2.9 months. The index was 3.2 months in August 2012. The index indicates the number of months needed to sell the supply of homes on the market at the current sales rate. A six- to seven-month supply is considered typical in a normal market.

• The median number of days it took to sell a single-family home also edged up to 28.8 days in August from 27.8 days in July, but was down from 41.1 days in August 2012.

• Mortgage rates moved higher in August, with the 30-year, fixed-mortgage interest rate averaging 4.46 percent, up from 4.37 percent in July 2013 and up from 3.60 percent in August 2012, according to Freddie Mac. Adjustable-mortgage interest rates in August averaged 2.65 percent, slightly down from 2.66 in July but down from 2.67 percent in August 2012.

Leave a Reply