Friday, April 30th – The 1st time home buyer tax credit expired at midnight June 30, 2010. Stick a fork in it’s done! Ding dong the witch is dead! Hallelujah!

Friday, April 30th – The 1st time home buyer tax credit expired at midnight June 30, 2010. Stick a fork in it’s done! Ding dong the witch is dead! Hallelujah!

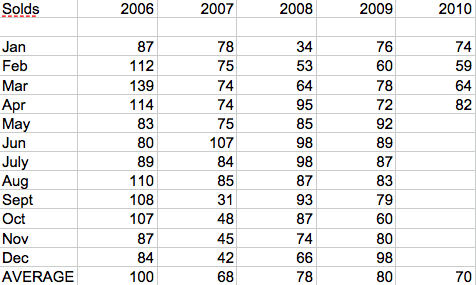

Okay what’s wrong with me? While the first-time home buyer’s tax credit was designed to stimulate the market and I’m sure you could probably find a few parts of the country where this did occur, but in Simi Valley California the first time home buyer tax credit had very little impact if any on the sale of homes in the last year and a half (see table of Single Family detached homes sold in Simi Valley).

The 2010 first-quarter sales of Simi Valley homes saw a sluggish start. If the tax credit was the panacea then why did sales dramatically tail off after a record breaking December? While it looks like April 2010 sales picked up and will close out strong; the lesson here is that the increased activity we are seeing in April and that will follow in May and June, is deadline related. The deadline is what’s motivating these buyers to pull the trigger. Since there was no threat of losing the tax credit, buyers continued to flounder around and be critical of their purchase until the deadline drew near.

In California we have two more deadlines. Those taking advantage of the first-time home buyer tax credit only needed to get a home under contract by midnight of June 30, 2010. The next step, especially important if that home under contract was a short sale, is to get that escrow closed before June 30, 2010 to qualify for that tax credit. The second deadline will be the end of the year for those purchases in the state California. California in its infinite wisdom and expert money management activities at the state capital (sarcasm intended), has seen fit to offer $10,000 tax credit to home buyers for the remainder of 2010.

For those that took advantage of the tax credit, congratulations! For those who feel they may have missed out, I can only say that the government, my industry and the banking industry will fail big time if they try to force a market. There are many problems lingering in the markets, far too large to continue with tax credits. My phone rang more this weekend after the tax credits expired than it did in the last several weekends, I think that those planning to buy will still be able to find good properties for bargain pricing. Patients is all you need as a buyer for Simi Valley properties.

|

Thanks for reading Simi Valley’s Premiere Real Estate Blog!

Author – Ted Mackel Simi Valley Real Estate Agent – Keller Williams Realty

Ted Mackel is a top producer at Keller Williams Realty Simi Valley,

specializing in Simi Valley Real Estate

(805) 432-7705

[…] This post was mentioned on Twitter by Ted Mackel. Ted Mackel said: Ding Dong the Witch is Dead – 1st Time Home Buyer Tax Credit Expires http://bit.ly/cluQLD […]