False Recovery? How Fragile is the Simi Valley Real Estate Market

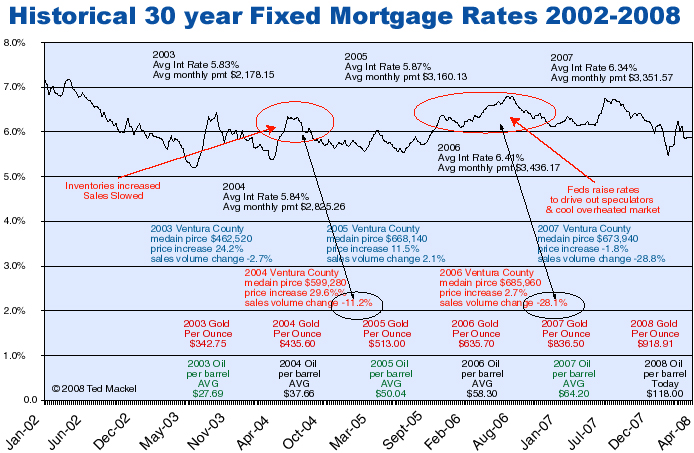

This is a chart I whipped up last year trying to illustrate what a mortgage interest rate does to the real estate market when it goes over 6%. I might have posted it before, but it really needs another look at with our current market conditions. Why this chart becomes even more important now is that the current market conditions are a false positive on recovery for the following unsustainable reasons:

- Low interest rates (under 6%). Rates can’t stay here below 6% forever

- Historically Low Inventory. Not enought supply to meet demand. As inventory levels increase buyers have more choices.

- Federal Tax Credits. $8,000 tax credt for 1st time buyers expires December 1st

- Unemployment. Double didgit unemployement still has a long way to go before recovering

- Average monthly payments can no longer be disguised lower with exotic financing to help drive up sales prices

- Renter Revolt – As soon as the prices move up enough to price renters out of the entry level markets sales will slow again.

If you are in the market to buy a home in Simi Valley, the frustration factor is getting to everyone, you are not alone. Only a good increase in inventory can help cool this market down. I pray for inventory for my buyers.

If you are a seller and cannot wait a few years before selling, this is the time to make a move as the low inventory creates less competition and the likelihood that you can move you home quickly if priced aggressively and made ready to show with a home stager or staged yourself.

If you would like to talk real estate in an open relaxed environment; follow me on Twitter @RealtorTed and watch for my updates as I usually go to Panera Bakery in Simi Valley one night a week and hang out for a few hours having coffee with local people talking about Real Estate, things around the community, computers etc. I hope to see you there!

Leave a Reply