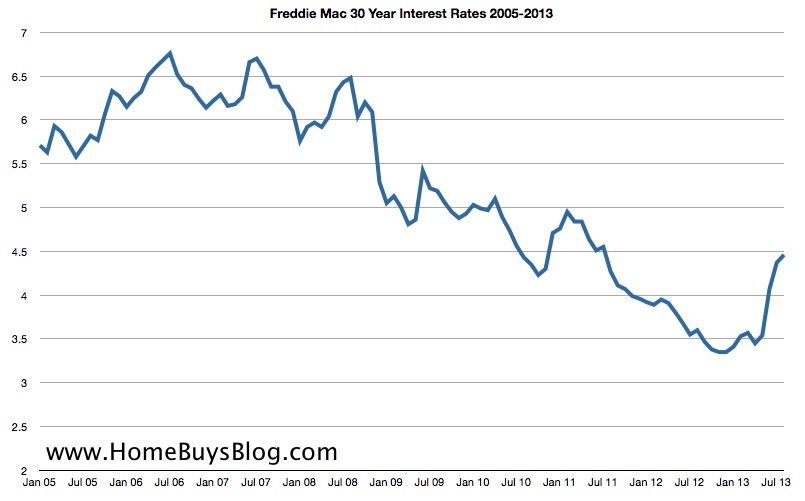

The Simi Valley Real Estate market saw a 10% drop in the number of homes sold for the month over June 2012. While this does not necessarily signal bad news is it probably the warning shot over the bow that the robust market we are experiencing will cool off somewhat over the next few months. Inventory is starting to ease with more homes for sale. Interest rates have been on the rise since the beginning of the year lows and Single Family Detached sales below $300,000 have dramatically shrunk.

Another noticeable shift in the market is happening with the homes selling between $400,000 and $500,000. This price range is now dominating sales and should continue to do so. This shift will make it difficult for investors to find rentals with cash flow or just straight out flip properties. We had a significant buyer pool that were qualified for homes under $350,000 that are now being priced out of the Simi Valley Single family detached market and with continuing interest rate hikes, those buyers will most like need to start looking at condos and town homes. There will still be opportunity for those properties needing facelifts and major upgrades, but outside of those opportunities, higher interest rates on homes priced over $400,000 will not create as many great investment opportunities.

The distressed market accounted for less than 25% of the sales which is a big shift from last year. Short sales continue to wind down as equity sales return to normal levels.

Take a look at the 30 year Mortgage Interest Rate since 2005

Leave a Reply