Competing home buyers are continuing to keep pressure on the Simi Valley housing market. Low inventory and interest rates below 4% are two primary factors pushing the market. With less than 90 homes for sale in Simi Valley on any given day, it’s no wonder buyers are frustrated when competing with multiple offers trying to lock down a home purchase.

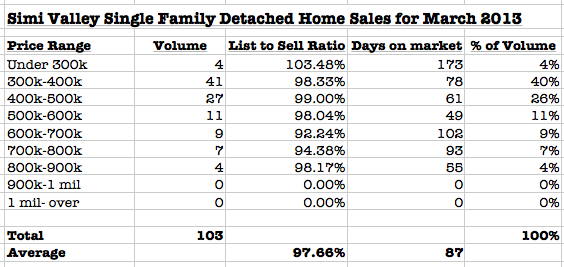

Housing sales for March 2013 still shows that homes selling below $500,000 and closer to the $400,000 range command the majority of the sales. While homes between $500,000 and $900,000 are improving, they were selling at an average of 5% below the original asking price. Part of the explanation as to why the lower end of the market is hotter has to with investor pressure looking for additional rental properties or flips.

Inventory of Simi Valley homes below $300,000 is declining and typically homes in that price range have condition or location issues that are holding those sale prices low. This trend should continue and we should expect to see very few single family detached homes for sale under $300,000 as we move to the later part of the 2013.

The market will continue to give home buyers fits until inventory begins to loosen. However, rising interest rates and rising prices are what will slow down this market and create more inventory, there is crystal ball to forecast when that will happen.

Distressed properties are in decline. Approximately 40% of all sold properties were short sales or foreclosures, with short sales out pacing foreclosures at a 9 to 1 ratio. More non distressed sales is good for overall health of the real estate market; this is happening and is welcome news.

Leave a Reply