Are we emerging from a depressed Real Estate Market in Simi Valley? Are you hearing rumors that the market is picking up? Well before getting to worked up over some promising numbers let’s dive in for a closer look to the activity in Simi Valley and understand what is going on. Simi Valley Home Sales are up, but what I mean by up, is the number of homes sold for the month increased. There is some minor and I mean minor improvement in the median and average sale price, but a closer look really shows that improvement to be quite flat. The increased volume is the most important number, because that is were any recovery is going to begin.

Are we emerging from a depressed Real Estate Market in Simi Valley? Are you hearing rumors that the market is picking up? Well before getting to worked up over some promising numbers let’s dive in for a closer look to the activity in Simi Valley and understand what is going on. Simi Valley Home Sales are up, but what I mean by up, is the number of homes sold for the month increased. There is some minor and I mean minor improvement in the median and average sale price, but a closer look really shows that improvement to be quite flat. The increased volume is the most important number, because that is were any recovery is going to begin.

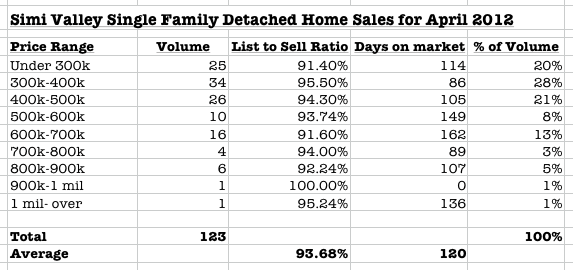

- 123 single Family Detached homes sold in Arpil 2012. That is up from 103 closings in March 2012.

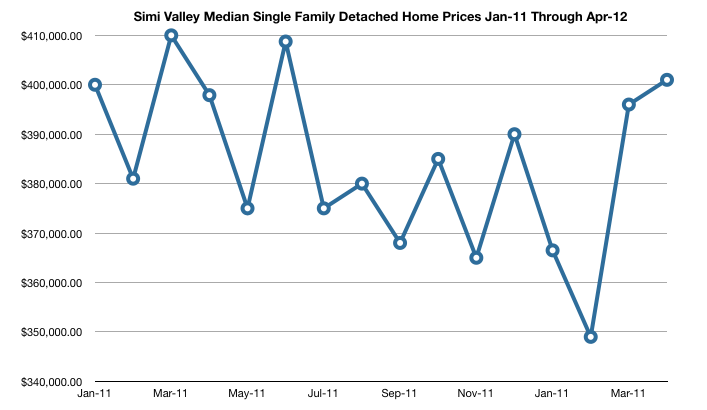

- Median Price for Simi Valley Single Family detached homes improved 2.8% over March

- Average price for Simi Valley Single Family detached homes improved 1.25% over March

There is no real 10% increase in pricing as rumored. I have heard that number thrown around, but it is just not in the actual hard data. Median Pricing and Average Pricing looks at all the sales for the given period. One thing that has not been the same month to month is the number of sales above $500,000. In March and April homes between $600k and $700k increased in sales volume over 3 times. This increase alone will raise the average sales price and the median pricing of homes in any given report. This becomes problematic because if you look at the sales individually the following is contradicting the perceived rebound:

- List to Sell ratios are 5% to 8% below the original starting price. Even the homes under $300,000 are selling 8.6% on average below their original offering price. Those homes are seeing multiple offers and steep competition, yet the more homes continue to sell under $300,000 each month.

- Inventory supplies are extremely low. With inventory supplies below 2 months. Prices should be driving up at a noticeable rate. They are not.

- Lending qualifications are not easing. Lending requirements are tough and to top that off, appraisers are not ready to give appreciation on pricing.

Just going on the Median and Average Sales price is not telling the whole story. The median increase in Simi Valley form January through April is 10% higher, but what do you tell a home seller who has had to drop the price on their home over the last few months. Why are homes across all given tracts hovering in the same price ranges these last several months? It’s because volume is up and as I mentioned earlier in this article more homes in higher price ranges are moving currently. That will always skew an average or median number.

Now to the “So what does this all mean” part of this blog post. It means that if you plan to sell your house, you can expect after hard negotiations a 5%-8% final sale price below your original list should not be a surprise. The exception to that rule is if your home is in pristine condition, meaning your home is well maintained, has upgrades and has been staged; these homes in superior condition are selling closer to full list price and sometimes over list price. If you are priced high, even though there is low supply, plan on a longer market time until your offering price will meet market demands.

Leave a Reply