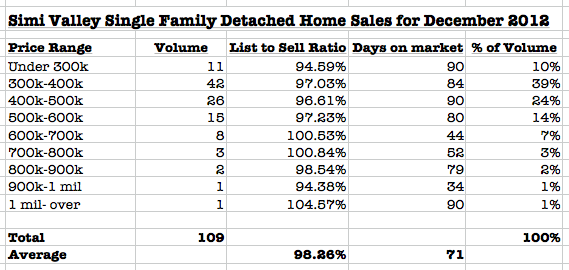

Sales of single-family detached homes in Simi Valley during the month of December improved slightly over the prior year’s totals. Median home pricing settled out at $400,000 and the average sale price retreated $27,000 at its lowest point since June 2012. Distressed properties still make up approximately 50% of all sales. Restricted inventories and low interest rates continue to push approximately 30% of the market to close at original asking price or above. The second strong month on low inventory levels is too little data to proclaim any type of trend, however buyers are taking advantage of cheap money and are competing with few homes on the market.

Sales of single-family detached homes in Simi Valley during the month of December improved slightly over the prior year’s totals. Median home pricing settled out at $400,000 and the average sale price retreated $27,000 at its lowest point since June 2012. Distressed properties still make up approximately 50% of all sales. Restricted inventories and low interest rates continue to push approximately 30% of the market to close at original asking price or above. The second strong month on low inventory levels is too little data to proclaim any type of trend, however buyers are taking advantage of cheap money and are competing with few homes on the market.

There was some thought that December should have been stronger with banks trying to close their books at year end. Additionally, fear of the expiration of the Mortgage Debt Relief act was thought to bring more sellers to try and short sell the properties before year-end. However, the increase in sales volume and inventory due to these events never was realized.

Investors remain bullish with lots of high down payment and cash offers for additional rental property and/or flips. I will probably say this a million times, but it is what has been going on for several months… that is with inventories below one month supply and interest below 3 1/2%, no one knows exactly how buyers will react if either inventory returns to normal levels or interest rates increase. however, it is well known fact, as interest rates increase, the buyer’s monthly payment can no longer drive home prices up in any sustainable rate. Further, if buyers have more homes to choose from and less competition for available homes, pricing will slow as well.

Surveying the sales that are taking place shows that conventional financing and cash buyers controlled approximately 80% of the sales leaving those with FHA and VA financing with only a 20% share.

Leave a Reply