Sales of single-family detached homes in Simi Valley are getting interesting. February’s numbers are showing support of my discussion that we are near or at a market bottom. Now those that live in hype, the carnival barker types, are probably out on every street corner prematurely celebrating recovery.

Sales of single-family detached homes in Simi Valley are getting interesting. February’s numbers are showing support of my discussion that we are near or at a market bottom. Now those that live in hype, the carnival barker types, are probably out on every street corner prematurely celebrating recovery.

Taking time and looking at what has happened over the last couple years and more specifically the last 12 months, what has become very clear and very simple as that this is a very good real estate market. However, it is only good for those who are educated on the main points that are driving this market.

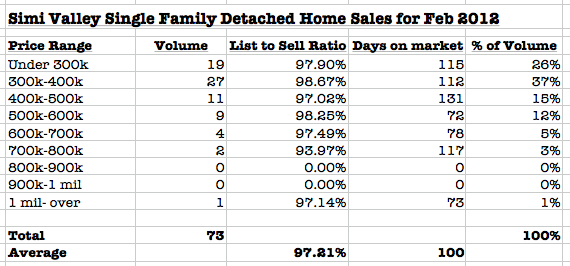

If you look at the chart (at the bottom of this post), the one thing that jumps out on the page is that all the list to sale ratios significantly improved. We need to understand why this is happening or we might as well join the premature celebration. As I have stated in prior reports, investor buyers and landlords have been out purchasing property at an increased rate for several months. Investors always lead the market while regular buyers stand back trying to find the exact timing for the bottom of the market.

So why are more homes going out close to full asking price?

Here the following factors:

- Pricing across most Simi Valley neighborhoods dropped as much as 10% in 2011

- Short sales comprise a significant portion of these sales. They are typically already priced below market and many times approvals are at list price or above. In surveying the short sales that closed escrow in February, more than 80% closed at the asking price or higher. This in no way can be considered as buyers rushing in to bid up pricing.

- Bank owned homes or foreclosed homes are being priced aggressively by their corporate owners to shorten market time.

- Many of the properties at their current pricing will generate decent cash flow if purchased for a rental.

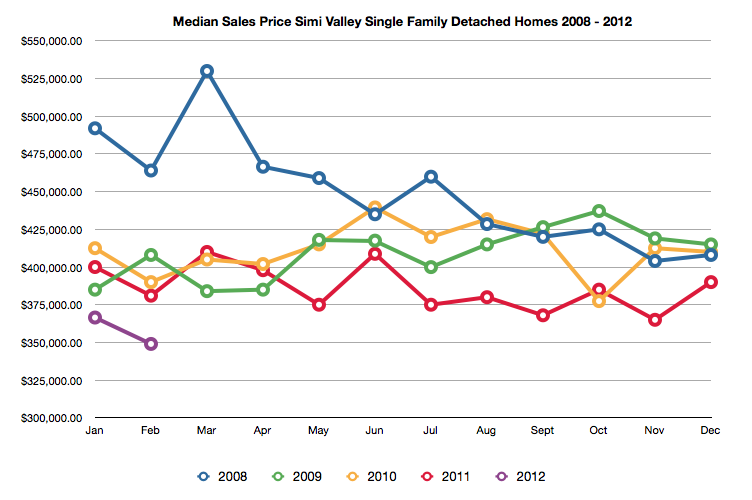

Again, looking at the chart and comparing to the prior months, volume has not increased. Median Price has been dropping each month with a brief bump up in December. February 2012 had the lowest Median Home Price for single-family detached homes sold in Simi Valley since I started tracking this metric back in January 2008. Average sales price of Simi Valley single-family detached homes has dipped below $400,000 for the very first time.

This is why it is extremely important to look at the overall picture. While pricing is probably at one of the most attractive affordability rates in a long long time, buyers are cautious and deliberate when it comes time to writing their offers. The one clear signal to continue to watch is the activity of the investors and landlords as they continue to snap up properties for their portfolios; buyers ready to buy a home today should not sit and try to time the market for an absolute bottom.

Inventory is extremely tight, prices as low as 2002 levels and with interest rates for conforming loans under 4%, we will see months like February and properties will begin to sell closer to asking price. Any upward move in pricing will be temporary as buyers will back off before participating in a run up.

Unless inventory increases we should expect to see some more of the same numbers for March Simi Valley home sales.

Unless inventory increases we should expect to see some more of the same numbers for March Simi Valley home sales.

Leave a Reply