As a Simi Valley Home Buyer in this market you will be confronted by many homes for sale that are Short Sales. Before submitting an offer buyers should be concerned and careful about the process they are about to enter. The current market conditions for buyers has been difficult for many. Inventory levels have been extremely low and Buyers have not had much freedom of choice.

As a Simi Valley Home Buyer in this market you will be confronted by many homes for sale that are Short Sales. Before submitting an offer buyers should be concerned and careful about the process they are about to enter. The current market conditions for buyers has been difficult for many. Inventory levels have been extremely low and Buyers have not had much freedom of choice.

Short sales are not only stressful for buyers, but they are equally stressful for sellers. The problems of a short sale can be divided into a couple different classes.

- Experience of the listing agent

- The number, type and complexity of the lien’s against the property

- The tolerance level of the buyer

The experience of the listing agent is critical to the success of the short sale. In a short sale, a loss mitigation department is assigned to the particular property in question. The individual assigned has many properties to oversee. Knowing the work load these loss mitigators carry, a good listing agent will either have a short sale negotiator working on the file, or will have the time to dedicate an aggressive campaign of keeping their client’s file at the top of the lost mitigator’s stack.

An experienced short sale listing agent will properly price the property so as to not create delays with the loss mitigator. What is important is, that the bank has already hired out for several Broker Price Opinions (BPOs) and possibly an appraisal. THE BANK KNOWS THE MARKET VALUE. Underpricing these properties is a serious mistake on the part of the listing agent, both for the buyer and the seller as the bank will have no motivation to undersell the property when they have the option and power to foreclose.

How well did the listing agent pre-qualify the property before taking on the listing? A short sale may be doomed before it is ever offered for sale. The more loans and liens the property has against it, the more difficult it will be to obtain an approval to sell the property short. Most properties have a first deed of trust and many others will have a second deed of trust. The holder of the first deed can pretty much call the shots, because if they foreclose the junior lien holders will receive nothing. If the property has additional liens, such as judgments, taxes, etc.; then these junior parties will most likely have to agree to take less than what is owed. In the case of Taxes, those will have to be paid and that will reduce what the other lien holder may expect. In the case of a judgment, remember those judgements in California can be renewed and follow a person around a long time, so the judgement holder may not be willing to take a reduced amount.

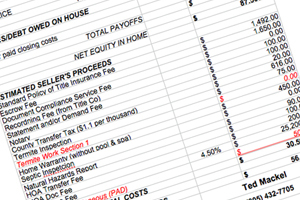

Here is an example, the property has a first deed of trust for $400,000, a second deed of trust for $100,000, a judgment from a lawsuit in the amount of $25,000. The home is currently worth $400,000 with supporting appraisals and BPOs. The holder of the first deed knows that there will be costs involved to sell the home and some sort of settlement for the holder of the second and the holder of the judgment. However if the first forecloses, the second and the holder of the judgment will get nothing. What if the holder of the second or the holder of the judgment demand more than what the first will willing to give? In most cases the holder of the second will probably be looking at getting no more than $10,000 and the judgment holder a couple thousand dollars. While these types of complex short sales can close after lengthy negotiations, it is important to understand as a buyer what you are getting into. It is important as a buyer to know if the listing agent has either the personal skills to pull this off or people working with them, such as a negotiator to pull this off. It is also important to know going in that three liens against the property are going to be more difficult to get approval on than in the case there is only one lien.

The buyer’s tolerance level is going to be tied to the expectations created by the agent that is representing them. Being told that short sales are long and lengthy process is not enough. Buyers should be educated on the process. Before the buyer writes an offer on a short sale, the buyer’s agent should get the background details on the property so the buyer knows what they could possibly be getting themselves into. Granted the buyer’s agent’s ability to get all the details will be limited, as the buyers agent cannot do a proper public records search without the seller’s Social Security number and driver’s license. However, the majority of the information should be available from the listing agent and from the information that real estate agents can obtain from title insurance companies. If the listing agent does not have detailed information on the number of liens against the property, then proceed with caution or maybe pass on the property until you can be satisfied with how big a task will be to negotiate a short sale.

I can only stress enough, with a short sale, is to go in with both eyes wide open. Be prepared for a long process and know when to walk away. you don’t have to stay away from a Short Sale if you know the things to look for and a Short Sale may be a better value than a foreclosure.

For more information on Simi Valley Short Sales:

- Taking A Short Sale Listing: “To Be or Not To Be?”

- What is a Short Sale & Can I Short Sell My Home?

- Simi Valley Short Sale Information

Thanks for reading Simi Valley’s Premiere Real Estate Blog!

Author – Ted Mackel Simi Valley Real Estate Agent – Keller Williams Realty

Ted Mackel is a top producer at Keller Williams Realty Simi Valley,

specializing in Simi Valley Real Estate

(805) 432-7705

[…] Simi Valley Home Buyers 3 Important Concerns with Short Sale Offers – If you are a buyer looking at possibly purchasing a short sale there are a list of things you […]