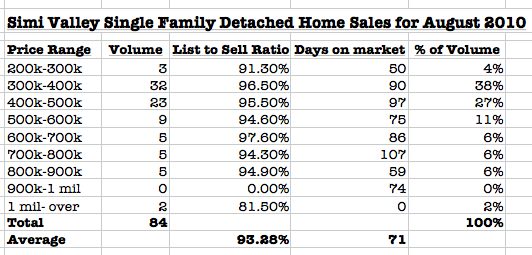

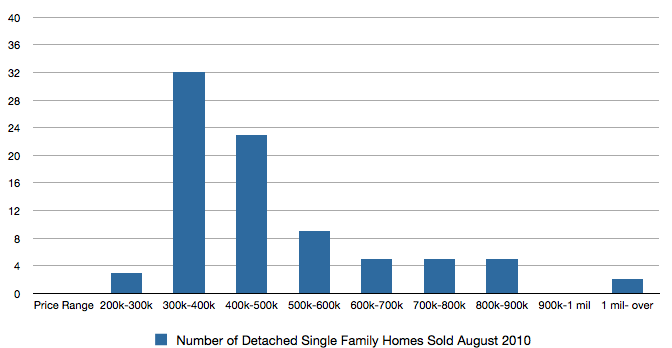

The number of single-family detached homes sold in Simi Valley for the month of August 2010 retreated slightly for a second straight month. While interest rates are favorable, loan qualification is tougher and buyers are not quick to jump into a purchase with the lack of tax credits for incentives. The popular price range continued to dominate the under $500K price range. The good news in the market is that the pricing has remained fairly stable over the last year. The Simi Valley Housing market hit a low in May of 2009 and we have not seen prices attempt any return tn those lows.

The number of single-family detached homes sold in Simi Valley for the month of August 2010 retreated slightly for a second straight month. While interest rates are favorable, loan qualification is tougher and buyers are not quick to jump into a purchase with the lack of tax credits for incentives. The popular price range continued to dominate the under $500K price range. The good news in the market is that the pricing has remained fairly stable over the last year. The Simi Valley Housing market hit a low in May of 2009 and we have not seen prices attempt any return tn those lows.

The market is still very sensitive with the following factors weighing heavily on it’s ability to recover.

- Employment – If people aren’t working, they aren’t going to qualify for financing. If companies are not creating jobs the economy is not growing. This creates a lack of confidence among home buyers.

- Interest Rates – Low interest Rates will entice buyers to enter the market, but any up-shift in rates reduces the buyer’s price range options and will slow the market.

- Short Sales – These homes available to buyers can afford some good value, however they are unpredictable and add to buyer uncertainty in the market place.

- Foreclosures – These properties are perceived as bargains, but usually are burdened with maintenance issues and difficult seller terms. The banks are slow to release these properties to market and the backlog adds to buyer uncertainty in the market place.

- Loan Modification – These potential sellers can spend many months trying to modify their loans before eventually trying to Short Sell their home. The long process to help these home owners adds to overall uncertainty in the housing market.

[…] This post was mentioned on Twitter by Ted Mackel, Hector G. Diaz. Hector G. Diaz said: RT @RealtorTed: http://fb.me/KAfaUB8c […]