Simi Valley Home Sales have been moving along at a similar pace and not much has changed. Inventory is still extremely low. There really is not much new to report in that the Tax Credits, low interest rates and low inventory are producing false positives for the news media to feed off.

Simi Valley Home Sales have been moving along at a similar pace and not much has changed. Inventory is still extremely low. There really is not much new to report in that the Tax Credits, low interest rates and low inventory are producing false positives for the news media to feed off.

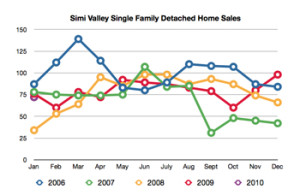

Simi Valley Single-Family Detached activity up through November 30, 2009 was as follows:

- Total Detached Homes Sold = 80

- Average Sale Price = $460,636

- Average Market Time = 81 days

Of these sold properties – 11 were short sales and 18 were foreclosures. The remaining 51 were non-distressed sales.

New listings coming on the market have already have slowed considerably as seller wait till after the holidays to make a decision whether to list or stay put.

Simi Valley Town Homes & Condominiums activity up through November 30, 2009 was as follows:

- Total Attached Homes Sold =15

- Average Sale Price = $278,514

- Average Market Time = 95 days

Of these attached properties sold, 4 homes were short sales and 5 homes were foreclosures. The remaining 6 homes were non-distressed sales.

Up through February has been typically slow for the Simi Valley Real Estate market and this year should follow pace as it has over the last 10 years. Any increase in inventory and buyer activity is welcome.

Factors that will continue to heavily influence this market are:

- LOW INVENTORY

- LOW INTEREST RATES

- FEDERAL & STATE TAX CREDITS

Why I believe the market cannot sustain any serious increase in pricing:

- Monthly Payments

- Lending requirements

Since I have not talked much about the last two items let look at how these will seriously affect the market over the next few years.

Monthly Payments – Buyers today will buy in their monthly payment comfort zone. If $2,200 per month is the budget for a buyer, then the ultimate purchase price is tied to interest rates. If the rates go down or stay low then the buyer can afford a larger purchase price, if the rates go up then the buyer will have to change their expectations in the home they plan to purchase or wait to see if the selling prices soften and lower to their affordable payment range.

Lending Requirements – Since the liars loans are a thing of the past, buyers will need to prove income and their ability to repay. No longer will buyers be able to qualify so high above their real purchasing level, that they will artificially drive pricing up.

The value increases in homes will be tied to what Buyers can afford spend on their monthly payment, in which the bank will no longer turn a blind eye to income.

What we need to help move this stalemate along is employment which in turn means that government will have to create a climate in California to keep business from moving outside the state. The uncertainty of employment is a big key to our problems and one that needs attention.

Updates from Prior Months can be found:

[…] November 2009 Report […]