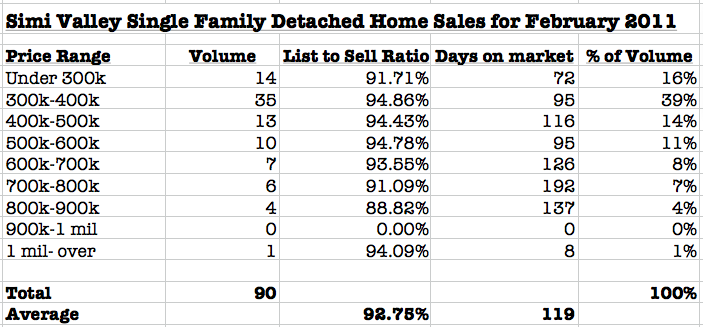

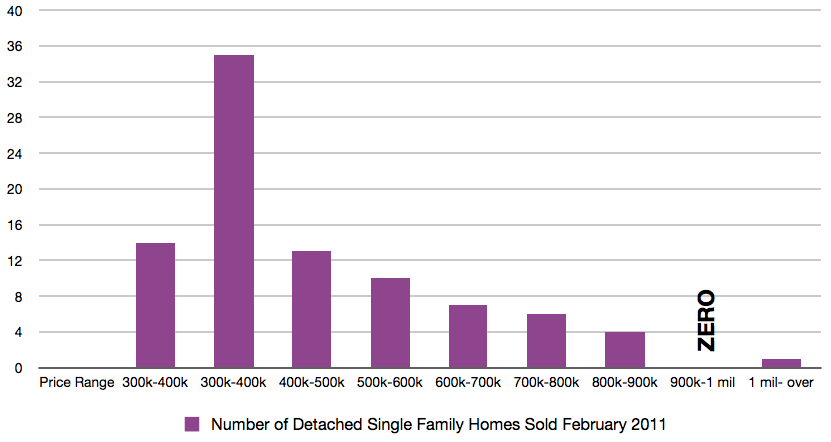

Simi Valley single-family detached home sales for February 2011 saw the highest volumes since 2006. While the typical response to a record month of sales was jubilation and claims of market recovery, looking closer at the numbers shows that while there was an uptick in the number of homes sold the market still has a ways to go before we can declare recovery. The continuing trend to watch is the increase of homes sold under $300,000. Most of 2010 saw a few sales under $300,000 per month, but as of December 2000 and the number is picked up. Even with record low interest rates last fall, buyers may have come out to purchase more homes, but higher volumes is not equating into higher prices.

Inflation impacting goods and services especially items like gasoline goes is taking money way that might be attributed to a buyer’s mortgage payment. Overall economic concerns of inflation and employment along with the continued impact of the short sale and bank owned property market are keeping housing prices down. Another factor to watch as the list to sell ratio. This is the difference between what a home was originally listed for and what the seller eventually accepted as an offer. The number typically is in the 3% area, however looking below the number has grown to 5% and higher on average.

Leave a Reply