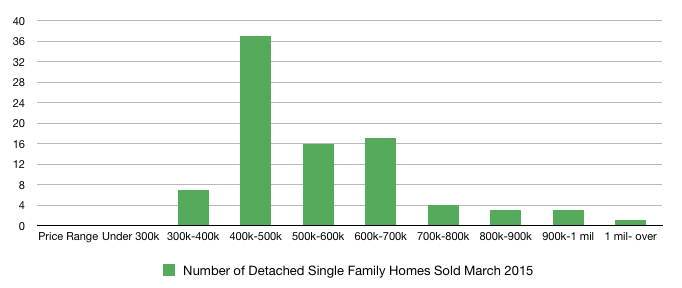

The Simi Valley housing market is moving with sales volume up over February and even the previous March. While more houses sold, gains in price were flat. The Simi Valley median price remained the same at $500,000.00 and the year to date improvement on median price is only 2.73%. The Federal Reserve Bank is hinting at beginning to raise interest rates in June of this year. Increased buyer activity may be tied to this news, however increased inventory along with cautious buyers has not helped move prices upward at the pace home sellers would like to see. Homes for sale between $400,000 and $500,000 still dominate the market with days on market across all price ranges at approximately 70 days. Buyer are paying close to full asking price with the average final sale price coming in at just 2.33% below original asking price. Seller’s should keep an eye on the news for which way the Federal Reserve Bank will move with interest rates. Any hike in rates will negatively affect prices in the Simi Valley housing market and could slow the market.

The Simi Valley housing market is moving with sales volume up over February and even the previous March. While more houses sold, gains in price were flat. The Simi Valley median price remained the same at $500,000.00 and the year to date improvement on median price is only 2.73%. The Federal Reserve Bank is hinting at beginning to raise interest rates in June of this year. Increased buyer activity may be tied to this news, however increased inventory along with cautious buyers has not helped move prices upward at the pace home sellers would like to see. Homes for sale between $400,000 and $500,000 still dominate the market with days on market across all price ranges at approximately 70 days. Buyer are paying close to full asking price with the average final sale price coming in at just 2.33% below original asking price. Seller’s should keep an eye on the news for which way the Federal Reserve Bank will move with interest rates. Any hike in rates will negatively affect prices in the Simi Valley housing market and could slow the market.

Community Home Buying & Selling Real Estate Guide

Insider's Guide to Real Estate Research & Home Owner Information

Leave a Reply