If Simi Valley home sales remain strong, how come pricing remains flat?

If Simi Valley home sales remain strong, how come pricing remains flat?

Before I bore you with all the detail and numbers, here’s a layman’s version for what is happening in the market. The available number of homes for sale in Simi Valley is extremely tight. Interest rates for home loans are at a historic lows. The number of homes selling each month is strong. Typically when you combine these factors, home prices should drive up. The increase in competition with a few homes for sale each month has not driven prices up but has stabilized the market. Even with many homes seeing multiple offers, homebuyers remain cautious and many of those competing offers are coming in below asking price.

Simi Valley home sales had another strong month in July with 114 sales for the month. For the year, only January and February saw sluggish sales while the remaining months have averaged over 114 sales. From 2008 through 2010 Simi Valley saw average monthly volumes total 80 sales per month and that number started moving up in 2011 with an average of 88 sales per month.This increase in activity should not be surprising when you look at the 30 year mortgage interest rates that have been averaging below 3.75%; it’s no wonder why more buyers have been out making purchases and locking down incredible interest rates. Many ask, “then why is this not driving prices up?” A few factors are playing a big role in keeping a lid price increases.

- Lending requirements – Those that qualify for loans now are typically very conservative, low risk takers. Lending requirements are so strict that those buyers that tolerate more risk and those that are a little less conservative, may appear to lenders to be just outside the box of requirements and have all be locked out of the market. These buyers that are locked out tend to help drive markets.

- Buyer perception of market conditions – There is still a fairly large percentage of the buyer pool that believes there is more downside to the market. Even with low inventory and low interest rates, buyers still ask if we’ve reached the bottom of the market. This cautious attitude will not help drive prices up.

- Economic uncertainty – availability of jobs, the condition of the local economy, state economy and national economy still weighs heavily on the minds of all consumers.

- Weak Offer Prices – Many of the Simi Valley home sellers I’ve spoken with this year, the report the same trend. That even when faced with multiple offers, many of those offers still come in below asking price and fewer come in over asking price.

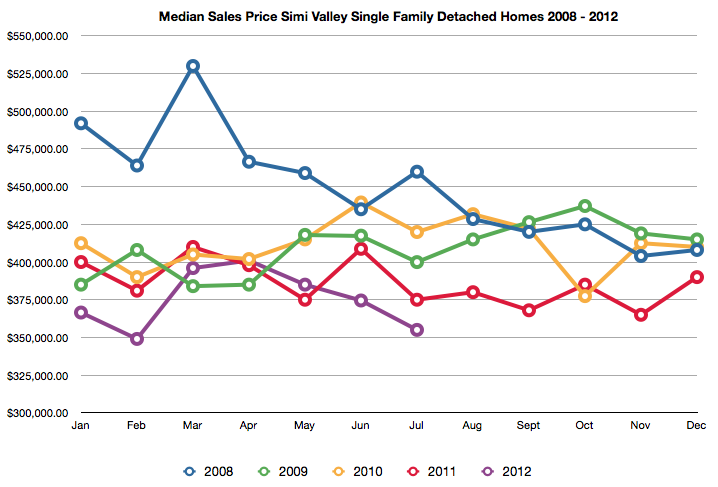

The median sale price is an interesting number to follow, as it’s fluctuation can quickly indicate the health of the upper end of the market. Wide changes in the median home price typically reveal the condition of upper market activity. Activity in the upper end of the Simi Valley housing market for 2012 is as follows:

- $600,000 to $700,000 – 63 homes sold or just under seven sales per month.

- $700,000 to $800,000 – 27 homes sold for just under three sales per month.

- $800,000 to $900,000 – 15 homes sold for just under two sales per month.

- $900,000 to $1,000,000 – 2 homes sold or not even an average of one sale per month.

- $1 million and over – 6 homes sold or close to one sale per month.

Of note, the homes listed for sale between $900,000 and $1 million totaled eight for this year and only two closed escrow, one property for $900,000 the other property for $910,000, with the remaining six properties all closing escrow below $900,000.

The information to be gleaned from all this data is important to those who have a home for sale or who are preparing to put their home on the market; that even though the news reports a strong Real Estate Market, it is important to look at how the market is reacting locally and be prepared for those local market conditions. Buyers should also note that waiting for more downturn in the market may be foolish. Volumes are up for two reasons, low prices and low interest rates. Any savings in the sale price on any property can be wiped away by rising interest rates. While low inventory might limit choices, buyers should remain flexible especially when that “right property” comes along.

See Related Articles:

Leave a Reply