Some of the effects of low inventory are starting to set into the Simi Valley housing market. Generally when inventory tightens and home buyer choices are limited, competition for existing homes should drive prices upward. In talking to home sellers across Simi Valley and experience from the transactions I have been involved in recently; when the offers come in, there is still a significant portion of buyers writing offers below list price even knowing they are in a multiple offer situation. Offers coming in over asking price are generally not significantly over the asking price and many times include seller concessions, like seller paying buyer closing costs.

Some of the effects of low inventory are starting to set into the Simi Valley housing market. Generally when inventory tightens and home buyer choices are limited, competition for existing homes should drive prices upward. In talking to home sellers across Simi Valley and experience from the transactions I have been involved in recently; when the offers come in, there is still a significant portion of buyers writing offers below list price even knowing they are in a multiple offer situation. Offers coming in over asking price are generally not significantly over the asking price and many times include seller concessions, like seller paying buyer closing costs.

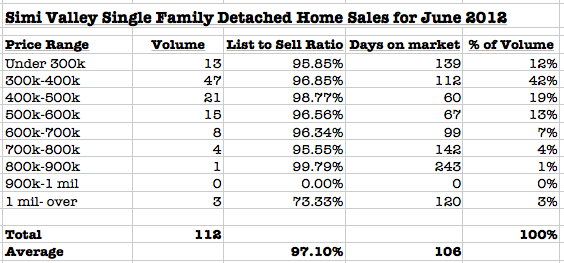

The gap between the original list price and final sales price has shrunk down to 3% and less between the $400,000 and $700,000 range. When you factor in the low pricing, low interest rates, the market should be whipped up into a frenzy.

Consider that in the $700,000 to $800,000 range only 26 properties have sold since January 1, 2012; that is just under four homes a month. Of these 26 homes, only 5 sold for list price or a little over. Five more of the 26 sold for 10% or more under the listing price with the rest averaging approximately 5% below the listing price. Certainly there are many positive indicators for the Simi Valley real estate market, but we need to avoid the hype. The reason why the hype from my industry is dangerous and the hype form local reporters can be dangerous, is that as a home seller you need to know how our local Simi Valley housing market is behaving. Buyers need to understand that they are not missing the market right now, but should be aware that further price decreases are not very likely. As a buyer the low interest rates or far more valuable than a another 5% decline in pricing. Thirty year amortization tables will erase any perceived savings in a 5% decline in pricing, especially at the pricing levels we are seeing across the Simi Valley housing markets.

As we move forward into the second half of 2012, I don’t expect to see much difference in the market. July should see 100-110 closings. Homes under $300k will still have sales prices 5% or more below the asking price. The $300k – $400k range will continue to dominate the highest volumes and homes over $700k will still continue to sell at a sluggish pace. We can expect that sales may back off in September-October, but experience a big end of the year push as banks try to clear Short Sale inventory off their books and home owners facing foreclosure try to complete a short sale before the tax relief laws expire at year end.

[…] June 2012 Sales […]