Simi Valley single-family detached home sales for the month of March 2012, significantly out paced each March since 2007. The last time more than 100 single-family detached homes sold in the month of March for Simi Valley was in 2006 before the bubble burst.

Simi Valley single-family detached home sales for the month of March 2012, significantly out paced each March since 2007. The last time more than 100 single-family detached homes sold in the month of March for Simi Valley was in 2006 before the bubble burst.

Does this mean the market has recovered and happy days are here again? If you look back at last month’s report for February, the list to sell ratio tightened, inventory tightened and prices between January and February were hitting lows. It’s no surprise that the buyers reacted so swiftly in snapping up available properties.

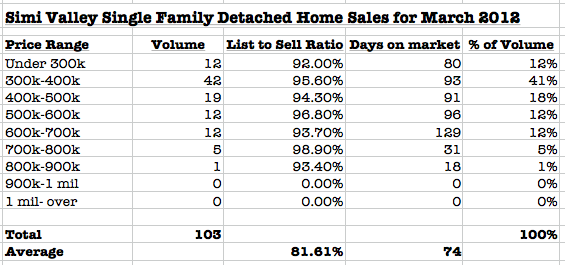

Looking at the closings for Simi Valley home sales in March, several trends stick out.

- List to sell ratio is not tightening across all price ranges. In fact, in February, that ratio that tightened, is now loosened up again. Notice that the homes under $300,000 sold for as much as 8% on the average below the original listing price and in the $400,000 to $500,000 range, those homes sold for more than 5% below the original listing price.

- Simi Valley Homes over $800,000 have almost next to no closings, with no homes between $900,000 and $1 million selling at all since the beginning of the new year.

- Simi Valley homes under $400,000 continued to dominate monthly sales with over 50% market share.

Inventory for single-family detached homes in Simi Valley is running close to two months, which should indicate a market advantage to the seller. However, buyers are still negotiating hard, the list to sell ratio is not tightening and erratic interest rates are not driving prices up. Sellers are frustrated.

The Wells Fargo economic outlook for 2012 pointed out that S&P/CaseShiller Home Price Index has fallen every month since April 2011 and an additional 6% slide by the middle of 2012 can be expected, noting distressed transactions accounting for a significant proportion of sales. Wells Fargo estimates (conservatively) that the “shadow inventory” could number 2 million homes. These are homes with payments past due 90 days or more.

For Simi Valley we are excited to see elevated numbers in closings. Affordability is at all time highs. It is great to see buyers get out and take advantage of extremely low interest rates. Landlords are accumulating more rental properties and many purchases will deliver decent cashflow. We are starting to see property flippers run out of room and mostly because of the decline in pricing is catching those investors off guard. April should continue at a brisk pace as this is a traditional time of year where buyers start to emerge from hibernation. Low inventory should make this interesting, but I predict that any bid up frenzy will be short lived and buyers will retreat this time around when it starts to get out of hand.

[…] I mentioned in my Simi Valley March 2012 Market Report, Wells Fargo projects 2 million homes making up the shadow inventory that are up to 90 days behind […]