Single-family detached home sales for the month of November 2012 in Simi Valley slowed and finished below the trending average of 115 units per month for this year. This is somewhat of a surprise as the last couple years sales volumes increased near year-end, as the banks rushed to clear their books of short sales and foreclosed properties.

Single-family detached home sales for the month of November 2012 in Simi Valley slowed and finished below the trending average of 115 units per month for this year. This is somewhat of a surprise as the last couple years sales volumes increased near year-end, as the banks rushed to clear their books of short sales and foreclosed properties.

Extremely tight and restricted inventory has remained throughout Southern California. Simi Valley single-family detached inventories dropped below 100 units available for sale. Scarcity of this type always drives pricing and competition upward which was reflected in modest increases in the median home price and average home prices.

The median home price in Simi Valley rose above $400,000 for the first time since June 2011. While this may seem like an important milestone in the Simi Valley real estate market, conservative caution dictates that seriously restricted inventory levels and historically low 30 year mortgage interest rates at 3 1/2% have much to do with the turnaround and pricing. Scanning all price ranges for the month November and specifically looking at homes sold at or above original list price, the following was noted:

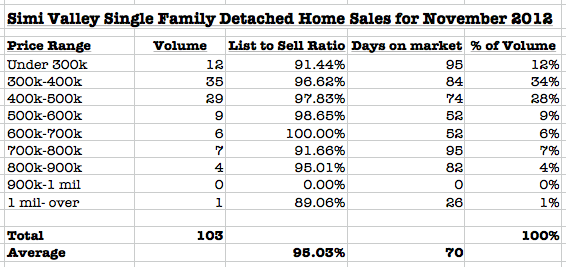

- One hundred three total properties in the single-family detached market sold in Simi Valley.

- Twenty Nine of the total properties sold, sold for full list price or above.

When properties sell more than 103% above the original list price, a closer look needs to be taken at each of the sales to understand what is happening.

- Eleven properties sold above the benchmark.

- Nine of those properties were short sales or foreclosures.

- Two properties were non distressed sales which started with list prices significantly below market value.

In other words, even though scarcity and aggressive interest rates are driving by the competition for properties, we are not seeing buyers lose their heads and drive values were buyers end up paying over appraisal values.

The big story that will remain the factor driving the Simi Valley Real Estate market will be the historically low 30 year mortgage interest rate combined with the restricted inventory levels. A combination these two factors will continue to stabilize prices and keep competition among those looking to purchase a home.

Simi Valley is seeing much of the same as it has over the course of the year with the lower end of the real estate market driving the majority of the sales, distressed properties including short sales, foreclosures and probates commanding half of the total sales and higher-end properties moving a slower pace.

Leave a Reply