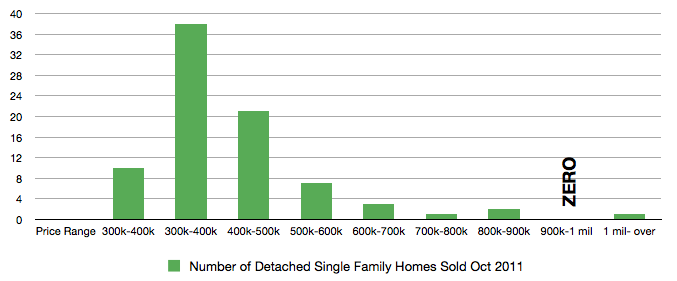

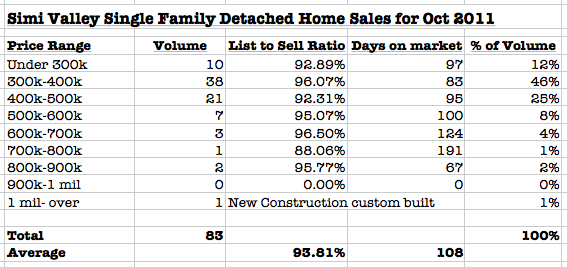

October Single Family Detached Home Sales for Simi Valley did not react much different that September. Volume is up over 2010 and 2009. Homes under $400k are pulling the lion’s share of the activity and as interest rates drop into low 4’s and high 3’s buyers still remain cautious.

October Single Family Detached Home Sales for Simi Valley did not react much different that September. Volume is up over 2010 and 2009. Homes under $400k are pulling the lion’s share of the activity and as interest rates drop into low 4’s and high 3’s buyers still remain cautious.

I mentioned last month the sluggish upper end of the market. If you have a home in the $900k to $999,999 price range, did you know that only 4, yes that is right FOUR homes have sold since January 1, 2011 in this price range for Simi Valley real estate? Currently there are 6 homes on the market in this price range and the last sale for the price range was in May. So, if you are listed in this range and wonder what is happening, wonder no more, even with attractive interest rates buyers for this range are not abundant at this time. At the same time, 10 Simi Valley homes have sold over 1 million with one of those being a custom spec house.

The ditressed market still is a major influencer on the overall market. RealtyTrac recently reported:

California default notices increased 17 percent from the previous month to a 13-month high, helping the state post the nation’s second highest foreclosure rate: one in every 243 housing units with a foreclosure filing in October. A total of 29,240 default notices were reported in California in October, a 1 percent increase from October 2010 — the first year-over-year increase in defaults in California since November 2009.

Even though other parts of the country are seeing some relief. However; Nevada, California, Florida and Arizona continue to battle through many struggling home owner’s loans with modification attempts, short sales and foreclosure.

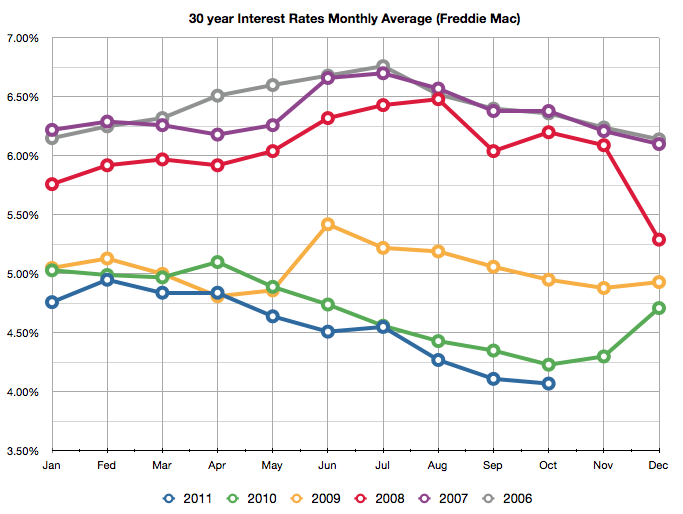

Below is the 30 year interest rate chart for 30 year conforming loans. 2011 has continues to average with the lowest rates. It is no wonder that investors are out snapping up deals with money this cheap. The Blue line below should be a wake up call to those sitting on the sidelines. The distressed market is continuing to to keep prices in check.

Leave a Reply