Simi Valley Real Estate Home Sales Market Update March 31 2009 YTD

The Charts in the video are posted below the table for further study.

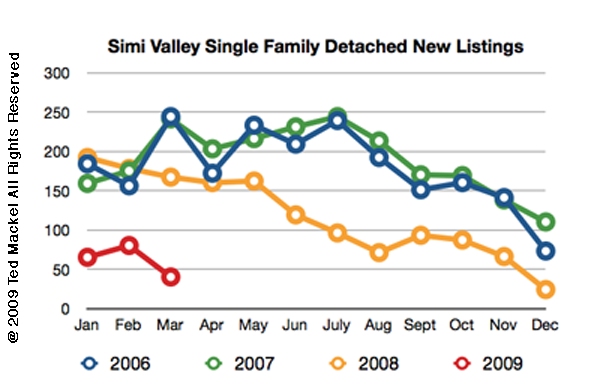

One disclaimer is that the MLS data adds the homes that are contingent in a backup status with the Active Listings. This is not a true picture for the real market conditions. A disproportionate number of these homes in backup status are Short Sales and could possibly be a home that never closes escrow. The picture is rosier than it looks. This is why I post the charts, so the information can be compared to prior years.

| Activity – Single Family Detached Homes | ||

| Active Listings | Simi Valley | Moorpark |

| Active | ||

| # Units | 354 | 137 |

| Average List Price | 584,746 | 1,007,419 |

| Average Days Listed | 122 | 105 |

| Pending Sales in Escrow | ||

| # Units | 120 | 22 |

| Average List Price | 430,727 | 525,809 |

| Average Days on Market | 69 | 54 |

| Total Closed Sales for 2008 | ||

| # Units | 212 | 57 |

| Average List Price | 445,630 | 609,357 |

| Average Sold Price | 436,334 | 583,091 |

| Average Days Listed | 85 | 80 |

| Average Closed Sales per month | 70.67 | 19.00 |

| Unsold Inventory Index (in months) | 5.00 | 7.21 |

| Activity – Single Family Attached Homes | ||

| Active Listings | Simi Valley | Moorpark |

| Active | ||

| # Units | 127 | 27 |

| Average List Price | 308,574 | 273,053 |

| Average Days Listed | 154 | 115 |

| Pending Sales in Escrow | ||

| # Units | 21 | 12 |

| Average List Price | 280,788 | 280,143 |

| Average Days on Market | 86 | 63 |

| Total Closed Sales for 2008 | ||

| # Units | 32 | 25 |

| Average List Price | 259,375 | 256,986 |

| Average Sold Price | 251,539 | 249,861 |

| Average Days Listed | 88 | 97 |

| Average Closed Sales per month | 10.67 | 8.34 |

| Unsold Inventory Index (in months) | 11.90 | 3.24 |

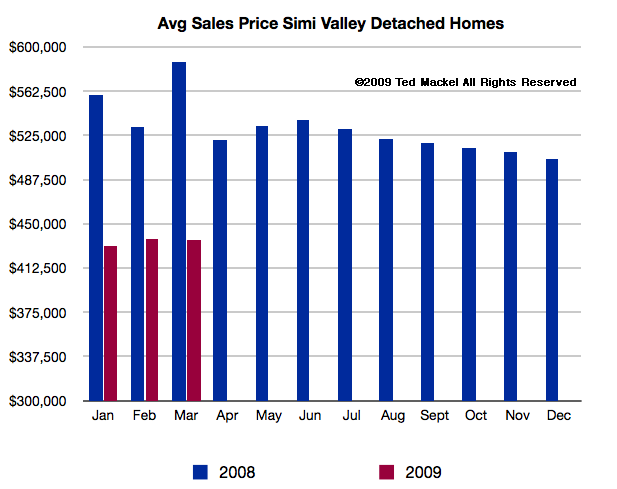

Looking at each year, 2009 has started off with an extremely tight inventory. This is causing the competition, but if you look at the chart below, typically we should see tight inventory driving prices up, but this is not the case. The drop in the average sales price between December and January was significant. It will take a few more months to see if this market stabilizes. My big wonder in all this is what would the market be like if we had the higher inventory levels like last year.

Ted,

Do you feel that houses were overvalued before, and on point now, or vice versa?

C.A.,

Thanks for stopping by. Here is the fundamental issue we are facing right now. Inventory is as tight as it has ever been. With such low inventories I have to wonder what will happen if we get an influx and how buyers will react with more choices.

The government is doing all kinds of things to make home buying attractive, rates are low, there is the $8,000 credit if you buy this year. We all have to wonder that when the incentives are gone and when there is a larger supply of inventory what might happen.

Affordability is over 50% right now, so that is a good indicator that we probably wont see another giant drop like we just went through, but I have a hard time seeing where prices will run up any time soon.