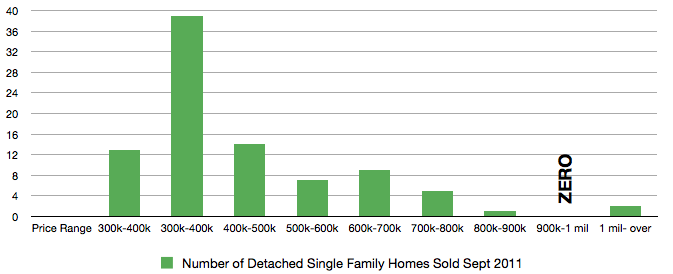

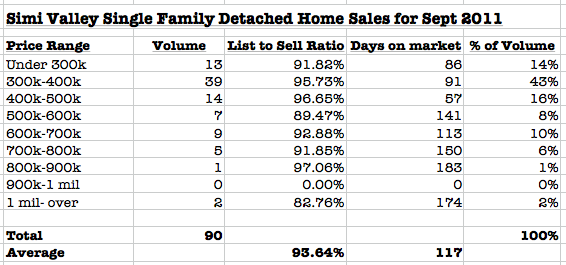

Do Simi Valley September Homes Sales show another false positive for the real estate market? In 2009 and 2010 September sales volume for single family detached homes tailed off after a 2008 rebound over a record low in 2007. Fast forward to today and low interest rates are enticing investors and home buyers to enter the market, however pricing is still flat. The market for homes below $400,00 is still leading the way with 53% of the sales for the month. 57% of those sales are dominated by Short Sales and Bank Owned homes. 25% of all the Simi Valley SFD homes sold were snapped up by all cash buyers and 40% with conventional financing. This high percentage of Cash and Conventional buyers shows that low interest rates combined with attractive pricing is bringing savvy real estate buyers to the table.

Do Simi Valley September Homes Sales show another false positive for the real estate market? In 2009 and 2010 September sales volume for single family detached homes tailed off after a 2008 rebound over a record low in 2007. Fast forward to today and low interest rates are enticing investors and home buyers to enter the market, however pricing is still flat. The market for homes below $400,00 is still leading the way with 53% of the sales for the month. 57% of those sales are dominated by Short Sales and Bank Owned homes. 25% of all the Simi Valley SFD homes sold were snapped up by all cash buyers and 40% with conventional financing. This high percentage of Cash and Conventional buyers shows that low interest rates combined with attractive pricing is bringing savvy real estate buyers to the table.

Pricing is in a low trough at this point and has remained in this trend for most of 2011. The mid to high $200k price point has solidified a low for Simi Valley Single Family Detached Housing and only dips below this range if the properties have significant damage. A recent article from CoreLogic® (NYSE: CLGX) stated:

“Even with low interest rates, demand for houses remains muted. Home sales are down in September and the inventory of homes for sale remains elevated. Home prices are adjusting to correct for the supply-demand imbalance and we expect declines to continue through the winter. Distressed sales remain a significant share of homes that do sell and are driving home prices overall,” said Mark Fleming, chief economist for CoreLogic.“

What does this mean for housing above the $500k price point? Those homes have trended selling at 8%-10% below the original list price showing the the market absorption rate for these houses is still dictated by buyer mood. The homes between $400k to $500k experience on average only a 3%-4% drop in price from List to Sell.

We can take away the following five points

- Low interest rates are bringing buyers out.

- Buyers refuse to bid up pricing and remain patient.

- Homes in well maintained condition are seeing short market times when price matches buyer sentiment.

- Investors are out accumulating rental property.

- Distressed property still make up over 50% of the inventory.

Leave a Reply