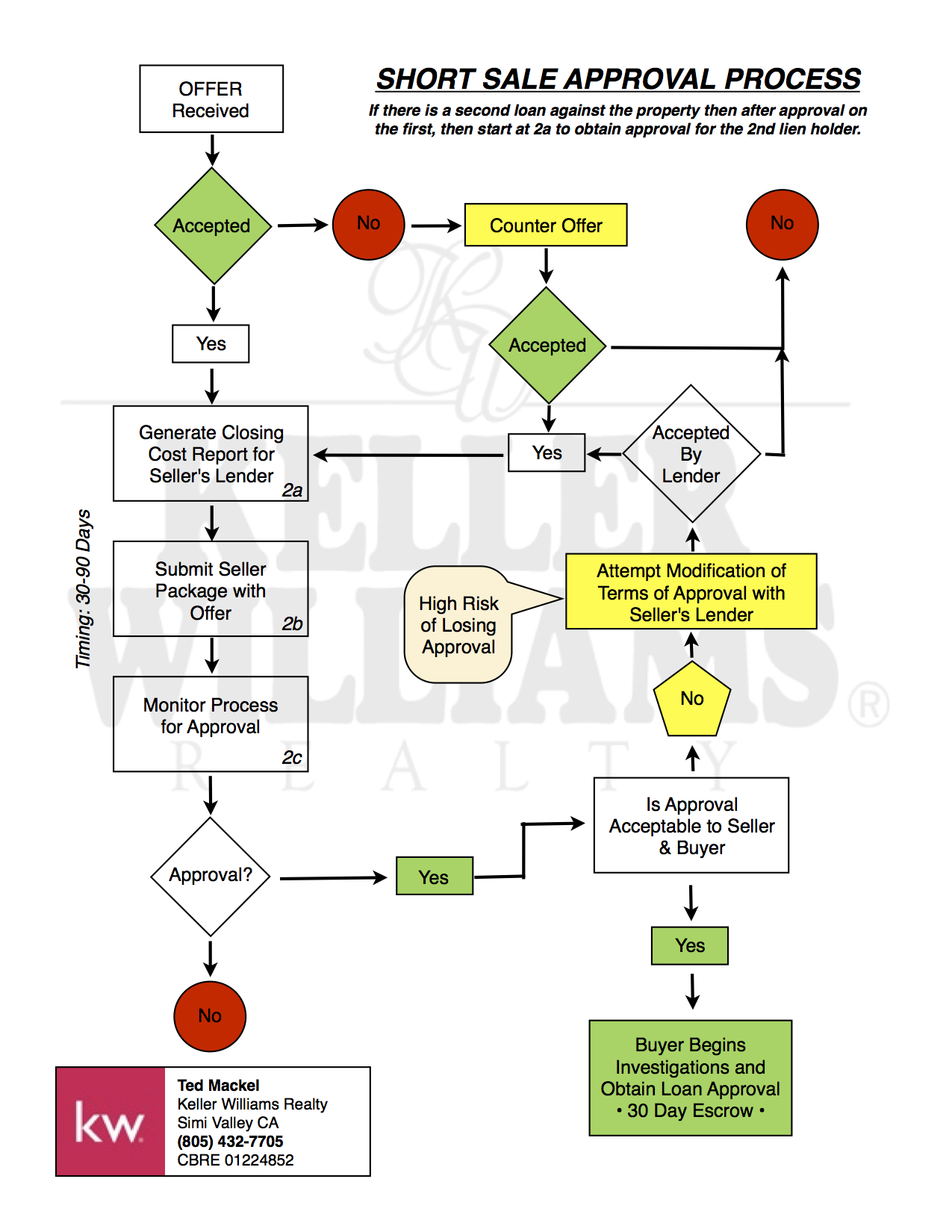

The Flow Chart below illustrates the short sale process from the time an offer is received until the Short Sale is approved.

What is in the Seller’s Package typically?

- Financial statement

- Hardship Letter detailing the particular hardship that has interfered with the seller’s ability to meet the current loan terms (payments).

- Copy of pay stubs – months of all pay stubs for all jobs. For pay stubs that are disability checks, also provide a copy of your disability awards letter. For Independent Contractors provide statement of last 12 months of income

- Copy of two years tax returns Federal Only with 2 consecutive years for each Borrower on the loan including all pages and schedules. Copies must be signed.

- Copies of utility bills for 2 month

- Copies of bank statements – 2 consecutive months of statements for all Bank accounts, Brokerage and Mutual Fund accounts for all Borrowers on the Loan

- 4506T federal tax transcript request form

- Copy of most recent mortgage statement(s)

- Copy of Property tax bill and Homeowners Insurance Policy.

- Any additional paperwork required by Lender (Lender’s Short Sale Application)

- If Divorced a court stamped copy of the final divorce agreement

- If self employed, a copy of recent Profit & Loss statements may be required.

* Some items such as a financial statement and hardship letter may be on forms provided by the Lender.

- A breakdown of the costs of the sale and the amount of proceeds left over for Lender

- Copy of the MLS sheet

- Copy of the listing agreement

- Copy of the Purchase Agreement

- Copy of the buyer’s earnest money deposit

- Copy of the pre approval letter for buyer’s financing

How does the Buyer’s Offer Price and the area Values affect the Short Sale Approval?

Short sales typically sell for less money than the surrounding area homes. One of the main reasons for the slight discount on price is the risk involved in buying one of these properties. Even though the buyers are able to investigate the property and are able to talk to sellers who live in the property with knowledge of the condition of the property; there’s usually no opportunity for the buyers to renegotiate or receive concessions if there are issues with the property. Short sales, much like foreclosures are “as is” sales.

One thing buyers of Short Sales need to keep in mind is that the seller’s lender may hire out for as many as three independent valuations of the property and many times these valuations are conducted prior to the lender receiving any short sale requests. The seller’s lender will also send out for an independent valuation during the approval process. The seller’s lender will take these valuations into consideration along with how long the property has been marketed for sale and consider this information in relation to the buyers offer price.

The seller’s lender will come back and ask for a higher purchase price if they believe the offer price is significantly below market value. Unless there are issues affecting the property that the seller’s lender is unaware of, chances of getting the sellers lender to sell below the value they have set for the property is not likely.

As recent as last week a Bank of America employee was arrested for proving short sales below market values. The employee was being paid bribes by investors or real estate agents, the article was unclear as to who was paying these bribes, however, there are people that will offer side money and/or cash to sellers and real estate agents to try and obtain short sale approvals significantly below area values. The goal of these people is so they can get the property significantly below value and can turn around and sell/flip the property for a quick profit.

Related Articles:

Beware of Short Sale FlippingThree Important Concerns With Short Sale Offers

10 Mistakes Home Buyers Make with Short Sales

Considering A Short Sale? Short Sale Information

I have read your post. Each and every thing described clearly and step by step. I like your Short sale process algorithm, its explained every thing, I am glad to come across your innovative post. Thanks