Who pays for What? What costs are customary for a buyer and seller varies from state to state and in some states like California, what is customary for buyers and sellers in Southern California may be different than in Northern California. The following list is what is generally customary for Home Buyers and Sellers in the Simi Valley and Southern California area on purchases, not involving distressed properties (i.e. Short Sales and Foreclosures/Bank Owned):

Who pays for What? What costs are customary for a buyer and seller varies from state to state and in some states like California, what is customary for buyers and sellers in Southern California may be different than in Northern California. The following list is what is generally customary for Home Buyers and Sellers in the Simi Valley and Southern California area on purchases, not involving distressed properties (i.e. Short Sales and Foreclosures/Bank Owned):

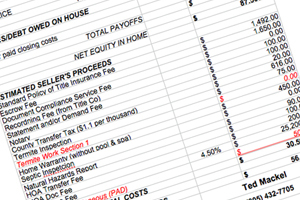

The SELLER can GENERALLY be expected to pay:

- Real Estate Commissions

- Document preparation fee for deed

- Documentary transfer Tax (deed tax stamps), if any

- Pay off all loans in Seller’s name

- Interest accrued to lender being paid off

- Statement fees, re-conveyance fees and any prepayment penalties

- Any judgments, tax liens, etc., against the seller

- Tax proration (for any taxes unpaid at the time of transfer title)

- Unpaid homeowner’s dues

- Recording charges to clear all document of record against the seller

- Any and all delinquent taxes

- Natural Hazards Disclosure

- Seller notary fees

- Escrow fee (one half)

- Title insurance premium for owners policy

- Homeowners Association transfer fee and documents fee

- City transfer/conveyance tax (or recording contract)

- Mandatory Government Compliance issues (i.e. Smoke detectors, Carbon-monoxide detector, water heater bracing, etc.)

The BUYER can GENERALLY be expected to pay:

- Title insurance premium for lenders policy

- Escrow fee (one half)

- Document preparation (if applicable)

- Buyer notary fees

- Recording charges for all documents in buyers name

- Property Tax proration (from date of acquisition)

- Appraisal

- Cost to run Credit Scores

- All new loan charges (except those required by lender for seller to pay)

- Interest Buy-down points

- Interest on new loan from date of funding to 30 days prior to first payment date

- Only if the buyer assumes the Seller’s mortgage – Assumptions/change of records fees for takeover of existing loan beneficiary statement fee for assumption of existing loan inspection fees (roofing, property inspection, sewer, pool, geological, etc.)

- Buyer insurance premium for first year

- Buyer’s investigations of the property including but not limited to Physical Home Inspection, Sewer Inspection, Wood Destroying Pest Inspection, Roof, Structural/Engineering, Soils/Geological, HVAC, Plumbing and electrical.

Typically Negotiated Under Contract

- Termite inspection (or according to contract)

- Termite work (or according to contract)

- Home warranty (or according to contract)

- Repairs on deferred maintenance (if agreed to or according to contract)

- Any bonds or assessments (or according to contract)

Related Articles:

Leave a Reply