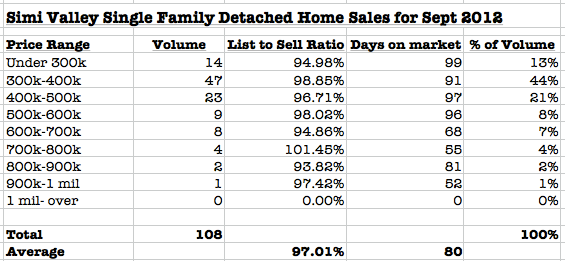

Homes Sales in Simi Valley for the month of September backed off slightly. The monthly average of 115 sales dropped to 109. While September is a busy month for many families, the restricted inventory and low interest rates still did not deter solid interest in home purchases. The Simi Valley housing market is very stable and will remain stable for the time being. Reports of a significant recovery are premature at this point due to the following:

Homes Sales in Simi Valley for the month of September backed off slightly. The monthly average of 115 sales dropped to 109. While September is a busy month for many families, the restricted inventory and low interest rates still did not deter solid interest in home purchases. The Simi Valley housing market is very stable and will remain stable for the time being. Reports of a significant recovery are premature at this point due to the following:

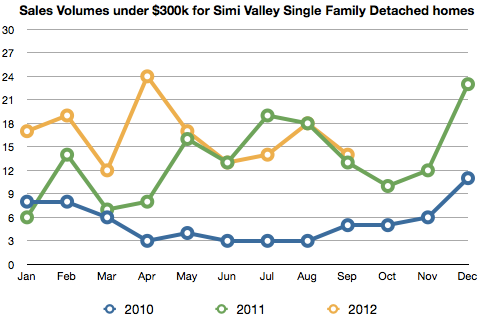

Homes below $300,000 – Simi Valley still has a higher number of single family detached homes selling for under $300,000 than it did in 2010.

Strict Lending requirements – Morgan Stanley in their July 20, 2012 Housing Market Insight report states “The lack of mortgage credit availability due to tightened lending standards and lower consumer qualifications is severely hindering home buying.” Fannie Mae, Freddie Mac and the FHA back close to 94% of all loans made. Fannie and Freddie have put the pressure on large banks like Bank of America, Chase, Citigroup and Wells Fargo to the tune of 3 billion in putbacks. In other words, making these banks buy back bad mortgages made prior to 2006. This pressure from the GSEs (Government Sponsored Entities), Freddie and Fannie are making it very difficult for potential home buyers to qualify for financing, as the banks forced to buy back the bad mortgages are tighten lending standards.

Low Inventory – Low inventory does not sustain any kind of stable price increases. I use this example all the time when talking about how few homes for sale affect the offer process; “when you are the only girl at the dance, all the boys will fight for that one kiss.” If you are a buyer and only have a few homes to see and they all go under contract shortly after entering the market, you know your options are limited. Some buyers are afraid to sit and wait for an increase in inventory with interest rates now below 3.5% for a 30 year fixed mortgage.

The September numbers are not much different that any of the last several months in Simi Valley. Important to note, that as of today there are just a little over 350 homes under contract, meaning they are in escrow. Approximately 66% of these properties are Short Sales. Foreclosures (REOs) are not increasing, but this is due to the Short Sale option for lenders which is working for the most part to keep homes from being foreclosed on.

Important issues for Buyers and Sellers:

Seller – Price right. Buyers will not over pay for homes, even with the increased buyer competition. Buyers rely on appraisal values and do not want to pay above market value, nor will their lender approve a loan unless the buyer brings in more money to compensate a selling price more than the appraisal. The condition of your home will have a significant impact on market times and final sale price. Do not over price your home, it will sit, even in this market.

Buyers – Inventory is tight, don’t make hasty unwise decisions over low inventory. Ask your Realtor for the area comps. A large percentage of properties in Simi Valley are short sales. If you want to compete, be prepared to make as clean an offer as possible. Asking for closing costs could cause you to over pay for the home, many Realtors and Lenders poorly advise their clients to ask for improper closing costs. Repairs and concessions may make your offer look weak when presented with multiple competing offers. You can get a good buy on a home in this market, even with all the obstacles that come with the competitive nature drive by low inventory; just make sure you call the right Realtor (hint hint).

thanx for sharing this …it clears many things in my mind